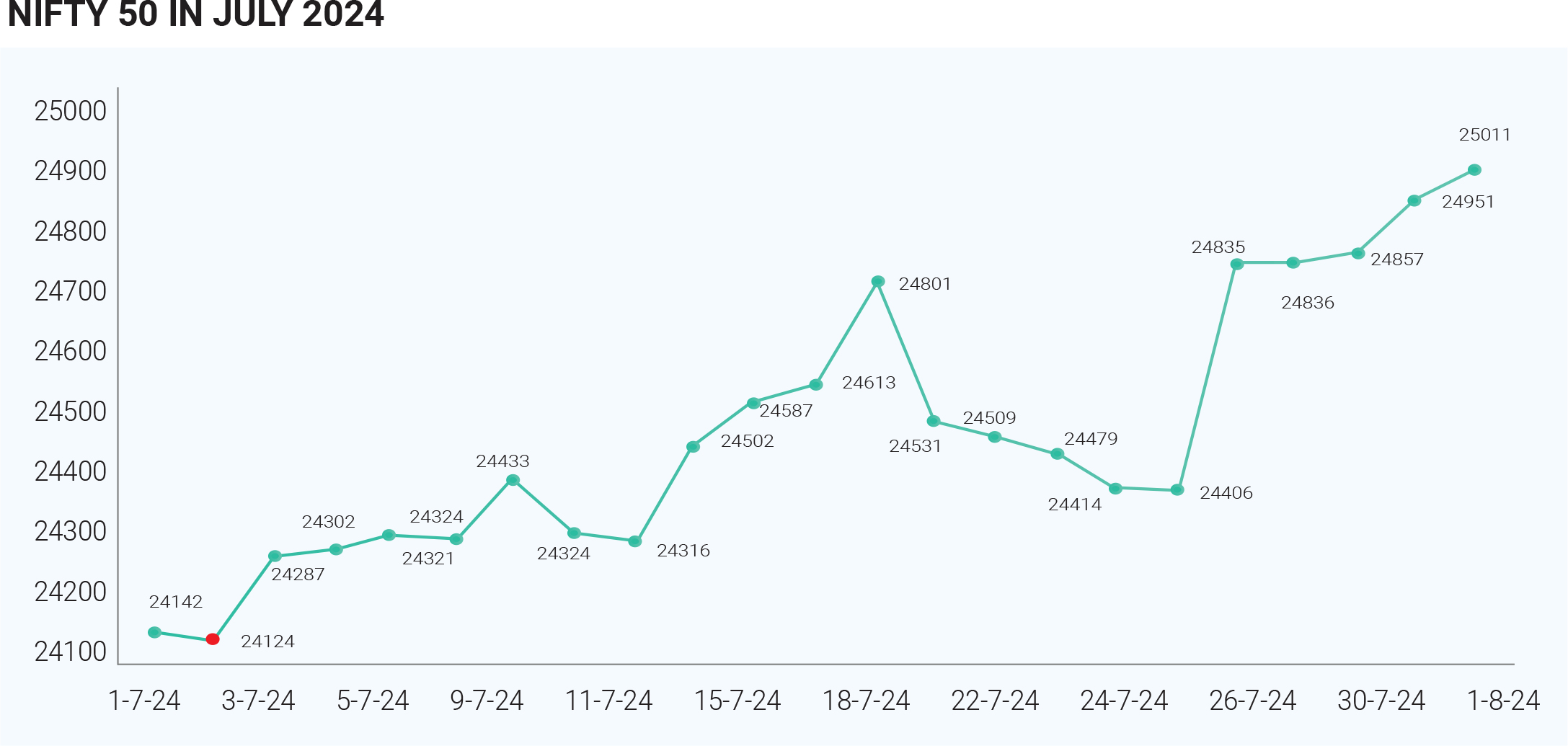

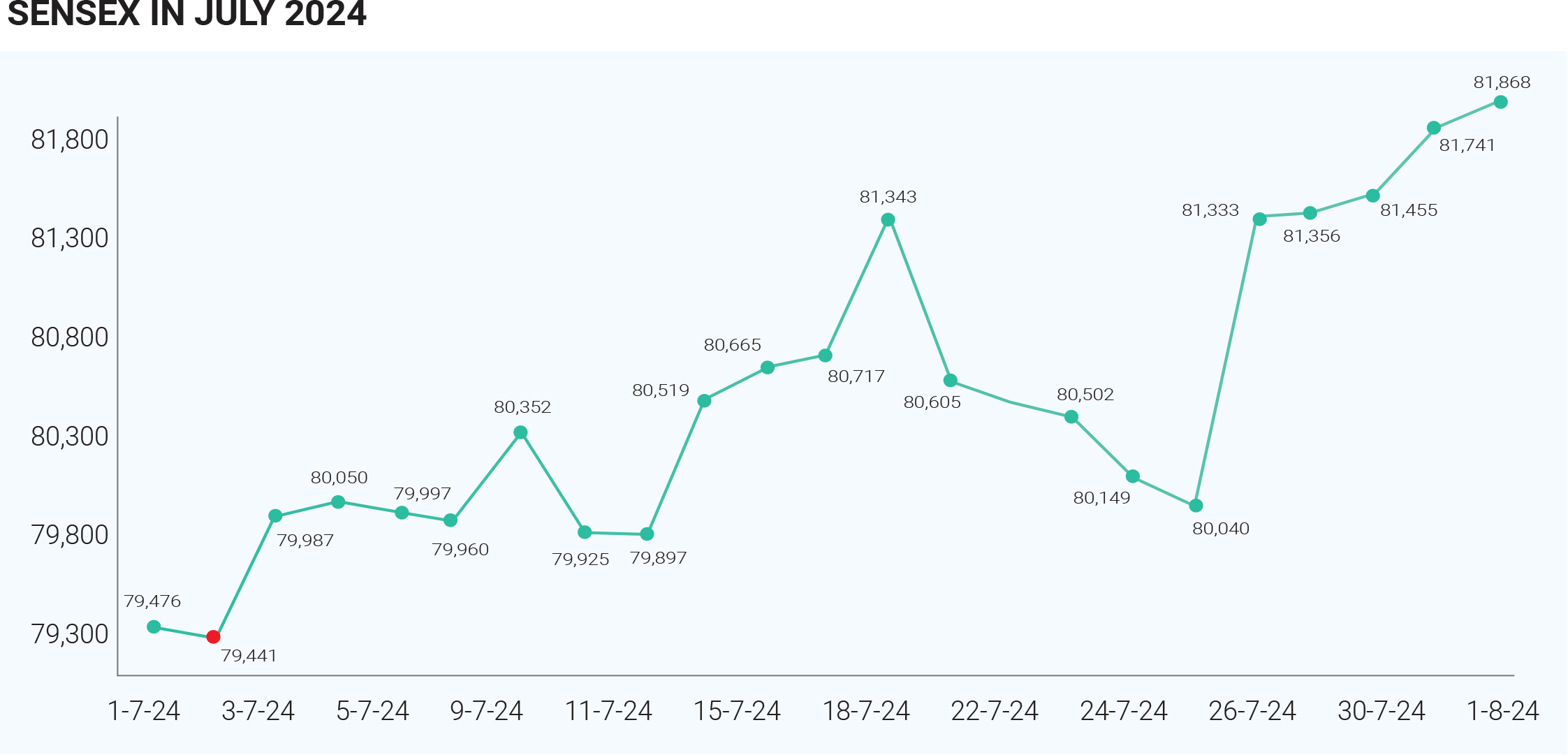

July 2024 was a month of heightened volatility for Indian stock markets. The confluence of the budget's tax changes, and the income tax return deadline created uncertainty among investors. Uncertainty prevailed over the stock markets as investors were hesitant about how the new tax regime would affect their investments, leading to fluctuations in stock prices and overall market performance. Despite of that still markets in July 2024, both the BSE Sensex and NSE Nifty showed remarkable performance, reaching all-time highs by the end of the month. The BSE Sensex closed at 81,741.34 on July 31, 2024, reflecting a gain of 285.94 points or 0.35% for that day. Throughout the month, it saw significant increases, including a notable rise of 1,292.92 points or 1.62% on July 26, when it closed at 81,332.72. On the other hand, the Nifty 50 finished at 24,951.15 on July 31, up by 93.85 points or 0.38%. The Nifty also reached a peak of 24,999.75 during the month, closing at an all-time high of 24,834.85 on July 26, marking an increase of 428.75 points or 1.76% from the previous close. The IT sector thrived on anticipation of US Fed rate cuts, contributing to overall market positivity. Certain sectors, such as metals and IT, exhibited particularly strong performances, contributing to the overall gains in the Sensex and Nifty. But the markets also faced some volatility, with the Sensex falling over 500 points on July 10 due to changes in the government's ethanol blending policy and raw material cost volatility.

Foreign Institutional Investors (FIIs) exhibited a mixed

trend in their investments in the Indian stock markets

during July 2024. FIIs net bought shares worth Rs

25,108.69 crore until July 22, 2024, showing strong

buying interest in the initial part of the month. However,

in the next three trading sessions after the Union Budget

2024 was presented on July 23, FIIs resorted to

offloading positions and net sold shares worth Rs

10,711.70 crore. This brought down their net monthly

purchases to Rs 14,396.99 crore thus far in July, despite

still being the highest net inflow in a single month since

the last 13 months. The sudden reversal in FII sentiment

in late July was driven by changes in the treatment of

capital gains for listed, unlisted and compulsory

convertible debentures (CCDs) in the budget. The

increase in short-term capital gains tax from 15% to 20%

and long-term capital gains tax from 10% to 12.5%

impacted FII flows. In coming months, FIIs will assess

their stance in Indian markets depending on the factors

like corporate earnings growth, global central bank

policies, geopolitics and the upcoming US presidential

election.

The Indian rupee exhibited a mixed performance against

the US dollar in July 2024. The rupee traded in a narrow

range, a situation not seen in almost thirty years. This

stability was attributed to the Reserve Bank of India's

firm control over the currency's fluctuations, supported

by its substantial foreign exchange reserves. While the

rupee saw some volatility in early July, it largely traded in

a tight range for the rest of the month due to RBI

intervention and stable foreign inflows, with forecasts

suggesting a modest appreciation against the US dollar

in the coming months.

In July 2024, gold prices in India experienced notable

fluctuations, reflecting a mix of global economic factors

and domestic market dynamics. Domestic gold prices

dropped by nearly 5% on July 26, 2024, with 22-carat gold

prices falling to ₹67,700 per 10 grams from a high of

₹74,700 on July 17. This unprecedented drop marked the

sixth largest wealth erosion in Indian market history. The

major factors behind this erosion are attributed to the

Budget 2024 on July 23, announcing a cut in the basic

customs duty on gold, silver and platinum from 15% to

6% and also global gold price declines more than 1% due

to profit booking by investors as they awaited key US

economic data and clues on Fed rate cuts.

In July 2024, crude oil prices in India largely traded in a

range around ₹6,400 per barrel in July 2024, with global

factors like refinery throughputs, demand from China and

OPEC forecasts influencing the price movements. The

overall trend was one of stability compared to the sharp

fluctuations seen in some previous months.

The Indian stock market is poised for a turbulent August.

While positive factors like the anticipated Fed rate cut in

September and strong performance in IT, metals, and

energy sectors offer some support, several challenges

could dampen investor sentiment. Lacklustre Q1 FY25

earnings, coupled with potential profit-booking and

consolidation in global markets, may exert downward

pressure. Additionally, the rupee's depreciation against

the US dollar could trigger capital outflows. These factors

combined are likely to introduce volatility and create

headwinds for the Indian market in the coming month.