The Union Budget 2023 unveiled a comprehensive

package of reforms, social programs, and regulatory

changes aimed at propelling India's development. This

Budget introduced significant changes to India’s tax

landscape, with a particular focus on international

financial transactions. While the revised income tax slabs

garnered much attention, modifications to the Tax

Collected at Source (TCS) under the Liberalised

Remittance Scheme (LRS) also had a substantial impact

on individuals sending money abroad. Let's explore into

the world of foreign remittances and the recent changes

brought about by the Indian government.

WHAT IS LRS?

The Liberalised Remittance Scheme (LRS) is a framework

established by the Reserve Bank of India (RBI) that allows

Indian residents to remit a certain amount of money

abroad for various permissible transactions. The

Liberalised Remittance Scheme (LRS) is a great help to

the one who does international transactions.

KEY FEATURES OF LRS

• Remittance Limit: Under LRS, Indian residents

can remit up to $250,000 per financial year for various

purposes, including education, travel, medical treatment,

and investments abroad.

• Permissible Transactions: The remittances can

be used for various purposes such as: Education

expenses, Medical treatment, Travel, Investments in

foreign assets and, Gifts and donations

• No Restrictions on Frequency: There are no

restrictions on the number of transactions, but the total

amount remitted must not exceed the annual limit.

• Documentation: Individuals must provide

necessary documentation, including a Permanent

Account Number (PAN), to facilitate remittances.

WHAT IS TCS IN FOREIGN REMITTANCE TRANSACTIONS?

TCS, short for, Tax Collected at Source, is the type of

income tax collected by the seller of selected goods and

services from the buyer. In the context of Foreign

Remittance Transactions, this kind of tax can be collected

from sender when he sends money abroad. Here, it is

crucial to note that sending money doesn’t only mean

sending it to someone. It could even imply touring abroad,

shopping, investing abroad, purchasing assets, etc.

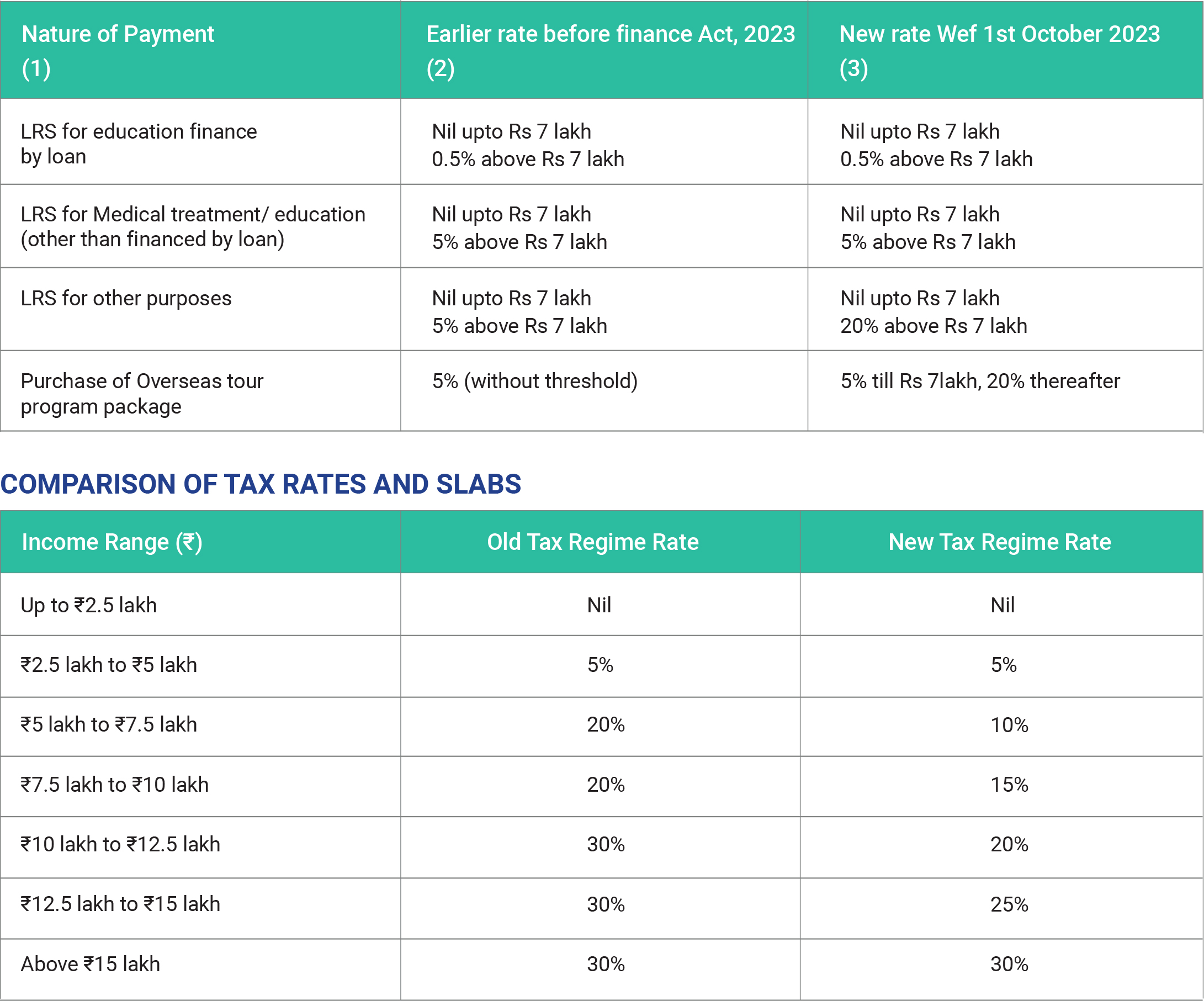

CHANGES PROPOSED IN BUDGET 2024

• For remittances under LRS, other than for

education and medical treatment, the TCS rate has been

reduced from 20% to nil for amounts up to ₹7 lakh per

financial year, effective retrospectively from July 1, 2023.

• For payments for overseas tour program

packages, the TCS rate has been reduced from 20% to 5%

for amounts up to ₹7 lakh per financial year, effective

retrospectively from July 1, 2023.

• A 20% TCS rate is applicable from October 1,

2023, for remittances under LRS (other than for education

and medical treatment) and payments for overseas tour

program packages exceeding ₹7 lakh in a financial year.

• International payments via debit card or Forex

card exceeding ₹7 lakh in a financial year are now subject

to LRS and a 20% TCS rate.

• International credit card payments have been

excluded from the ambit of LRS, effectively exempting

these transactions from TCS regulations.

• For educational expenses, there is no TCS on

foreign remittances below ₹7 lakh. For amounts above ₹7

lakh, TCS is 0.5% if the remittance is through a loan from

an approved financial institution, and 5% if not funded by

a loan.

• Any remittance for medical treatment above ₹7

lakh is subject to TCS at 5%.

• These changes aim to rationalise the TCS regime

for remittances under LRS, providing relief for lower-value

transactions while maintaining oversight for higher-value

remittances. The exclusion of international credit card

payments from LRS was a notable change in response to

practical challenges taxpayers face. LRS provides Indian

resident individuals with the flexibility to remit funds

abroad for various purposes, while adhering to the limits,

documentation requirements and tax implications set by

the regulations. Investors should be cautious to ensure

compliance with RBI guidelines.

KEY DIFFERENCES

• Tax Structure: The new regime has introduced

more tax brackets and lower rates for incomes up to ₹15

lakh, making it attractive for individuals who do not claim

many deductions.

• Deductions and Exemptions: Old Regime: Allows

numerous deductions, including those under Section 80C

(up to ₹1.5 lakh), HRA, LTA, and others, totalling around 70

deductions. New Regime: Offers limited deductions,

primarily the standard deduction of ₹50,000 and employer

contributions to NPS under Section 80CCD(2). The new

regime does not allow most exemptions and deductions

available in the old regime.

• Rebate Threshold: Under the new regime,

individuals earning up to ₹7 lakh can avail of a full tax

rebate, effectively making their income tax-free. In

contrast, the old regime provided a rebate only for

incomes up to ₹5 lakh.