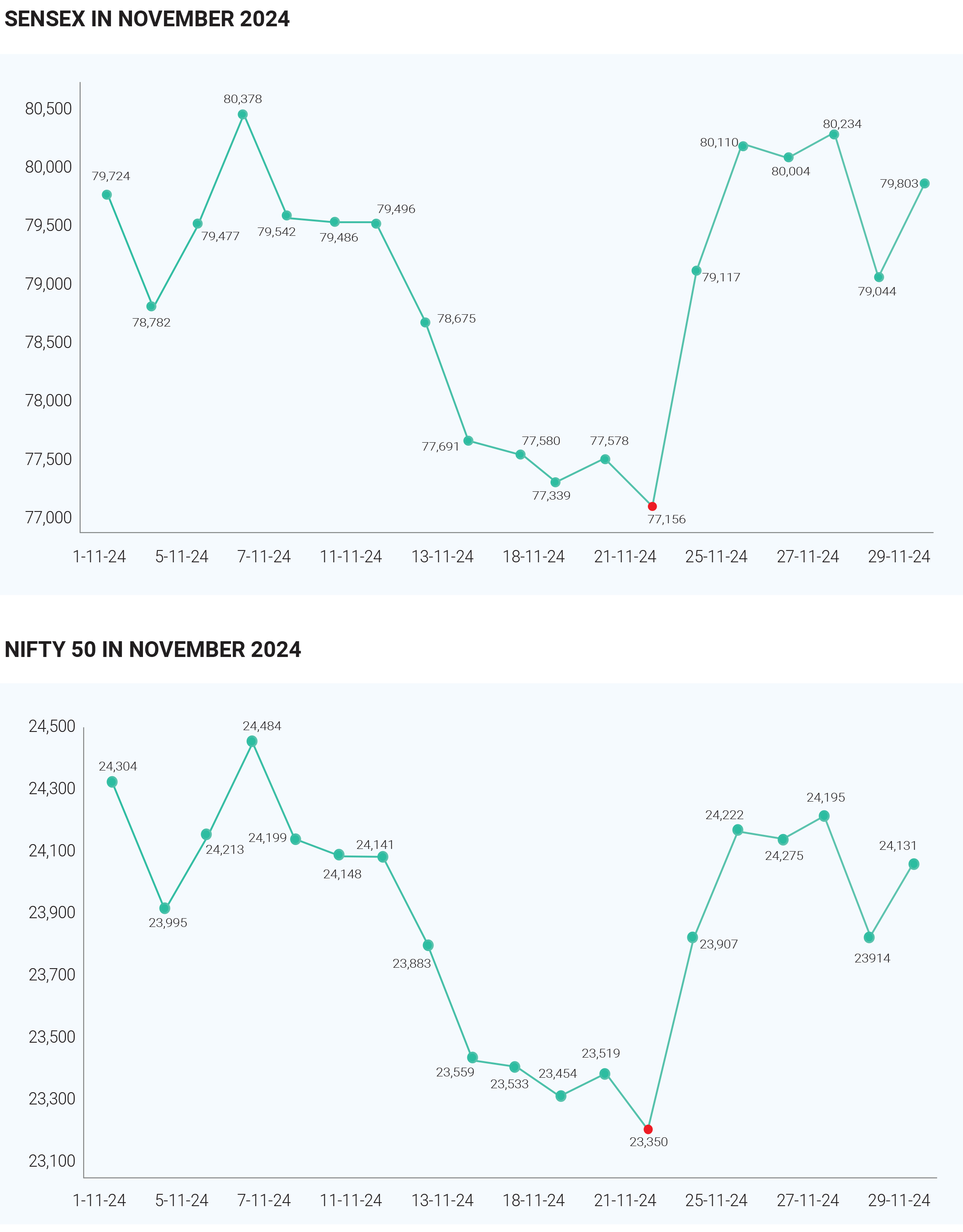

In November 2024, Sensex and Nifty 50 exhibited significant volatility but ultimately closed the month with minor gains. Sensex opened at 77000 points and stayed volatile throughout the month. After touching a high of approximately 81540 points, corrections in the later week pulled it down. By the end of November Sensex closed at 80248, reflecting an overall gain of about 1,961 points or 2.54% for the month. The Nifty started at around 23,500 points and also saw ups and downs. It reached a peak of about 24,498 points before closing at 24,276.05 points at the end of November. This represented a minor gain of approximately 144.95 points or 0.60%. Indian stock markets faced global and domestic challenges this month, from US election results to weak domestic economic numbers. In early November markets began with a notable decline, as the Sensex fell sharply over 1,100 points on November 28, closing at 79,043.74, while the Nifty dipped below the 24,000 mark. This drop was attributed to various factors, including concerns over high valuations and geopolitical tensions affecting foreign portfolio investments. During the mid-month market move in the recovery phase, till the 2nd of December, the BSE Sensex had rallied by 597 points to close at approximately 79,930.70, while the Nifty gained 169 points to settle above 24,400. Key sectors contributing to this recovery included auto, banking, financial services, and metals. Looking at the sectoral front, the automobile sector and the cement sector lead the pack. The strong monthly sales growth leading by Maruti Suzuki and Mahindra & Mahindra contributed heavily towards the overall market gains. UltraTech Cement and Grasim lead the rally in the cement sector. Telecom and Pharma sectors showed resilience during the month. Notably, telecom stocks were buoyed by favourable market conditions. Banking and financial services sectors also contributed positively to market recovery towards the end of the month, buoyed by investor confidence in financial stability and growth prospects. The high volatility sectors in November were energy, IT and construction, where significant price fluctuations happened due to various market dynamics like oil prices, corporate earnings, global cues, infrastructure spending, etc. Overall, small-cap stocks outperformed both mid-cap and large-cap categories in November 2024, driven by significant gains from specific companies amidst broader market fluctuations. This trend highlights the potential for higher returns in smaller companies, although they come with increased risk and volatility compared to their larger counterparts. In the first week of November, after Trump's victory in the US

election, the Indian stock market experienced a notable rally. The BSE Sensex surged by 901.50 points (1.13%), closing at 80,378.13, while the Nifty rose by 270.75 points (1.12%) to reach 24,484.05 on November 6. This positive reaction was driven by reduced political uncertainty and expectations of pro-business policies under Trump's administration. The major sectors such as IT, realty, and oil & gas saw substantial gains, reflecting optimism about continued demand for Indian IT services amid a favourable U.S. economic environment. During the month, FIIs faced substantial outflows leading to bearish trends, DIIs capitalized on this situation with strong inflows and increased allocations in specific sectors, thereby providing some support to the market amid volatility, a similar trend was observed in October 2024 too. FIIs continued to experience significant selling pressure, with net outflows reported at approximately ₹94,017 crore in October. On November 11 alone, FII selling amounted to around ₹2,026 crore, indicating ongoing withdrawal from Indian equities. Despite the overall selling trend, FIIs increased their allocation to the Healthcare sector, raising their share from 5.62% to 6.31%. However, they reduced their investments in the Financial Services sector, decreasing their allocation from 28.18% to 27.27%. The relentless selling by FIIs contributed to significant declines in major indices like the Sensex and Nifty, as their actions directly influenced market sentiment and stock prices. In comparison to FIIs, DIIs showed resilience with net inflows of approximately ₹1,07,255 crore in October, which likely continued into November as mutual fund investments reached an all-time high of ₹41,887 crore for that month. The share of DIIs in the market rose to an all-time high of 16.46%, up from 16.25%, indicating a growing influence of domestic investors in the capital markets. Their activities provided a counterbalance to FII selling and supported overall market stability. The release of US Economic data which is stronger-than-expected consumer spending raised concerns about the Federal Reserve's interest rate policies. Investors worried that this might slow down the pace of rate cuts, which had been anticipated due to earlier economic indicators. This uncertainty contributed to a bearish sentiment in global markets, including India, as traders adjusted their expectations regarding future monetary easing. The MSCI Asia-Pacific index (excluding Japan) experienced declines due to fears surrounding U.S. monetary policy and economic conditions. Also, China's stimulus package significantly influenced foreign investment patterns in India during November 2024 by prompting a shift in focus from Indian equities to Chinese stocks. This resulted in substantial capital outflows from India and increased market volatility, highlighting the interconnectedness of global markets and investor sentiment amidst changing economic conditions. The ongoing conflicts across the globe are escalating. Significant escalations in the Russia-Ukraine conflict are, characterized by increased military involvement from North Korea, heightened U.S. support for Ukraine, and intensified hostilities leading to civilian casualties and infrastructure damage. The geopolitical landscape remained complex as international stakeholders navigated their responses amid fears of further escalation and shifting dynamics influenced by Trump leading the U.S. political front. As Iran-Iraq conflict attacks increased, Iranian-backed militias in Iraq ramped up drone attacks against Israel, claiming responsibility for at least 22 attacks in early November. On the Israel-Palestine front, military operations in Gaza continued, where Israeli forces conducted clearing operations against Hamas and other militant groups. Hezbollah launched rocket attacks from Lebanon into Israel, demonstrating the interconnectedness of regional conflicts and the potential for broader escalation. As the year ends, the last month will be a potentially eventful month for the Indian stock market, with key developments such as the RBI MPC meeting, changes in index composition, corporate results and ongoing monitoring of economic indicators likely shaping the performance of the Sensex and Nifty. Investors should remain vigilant regarding global market influences and sector-specific news that could impact trading dynamics throughout the month.