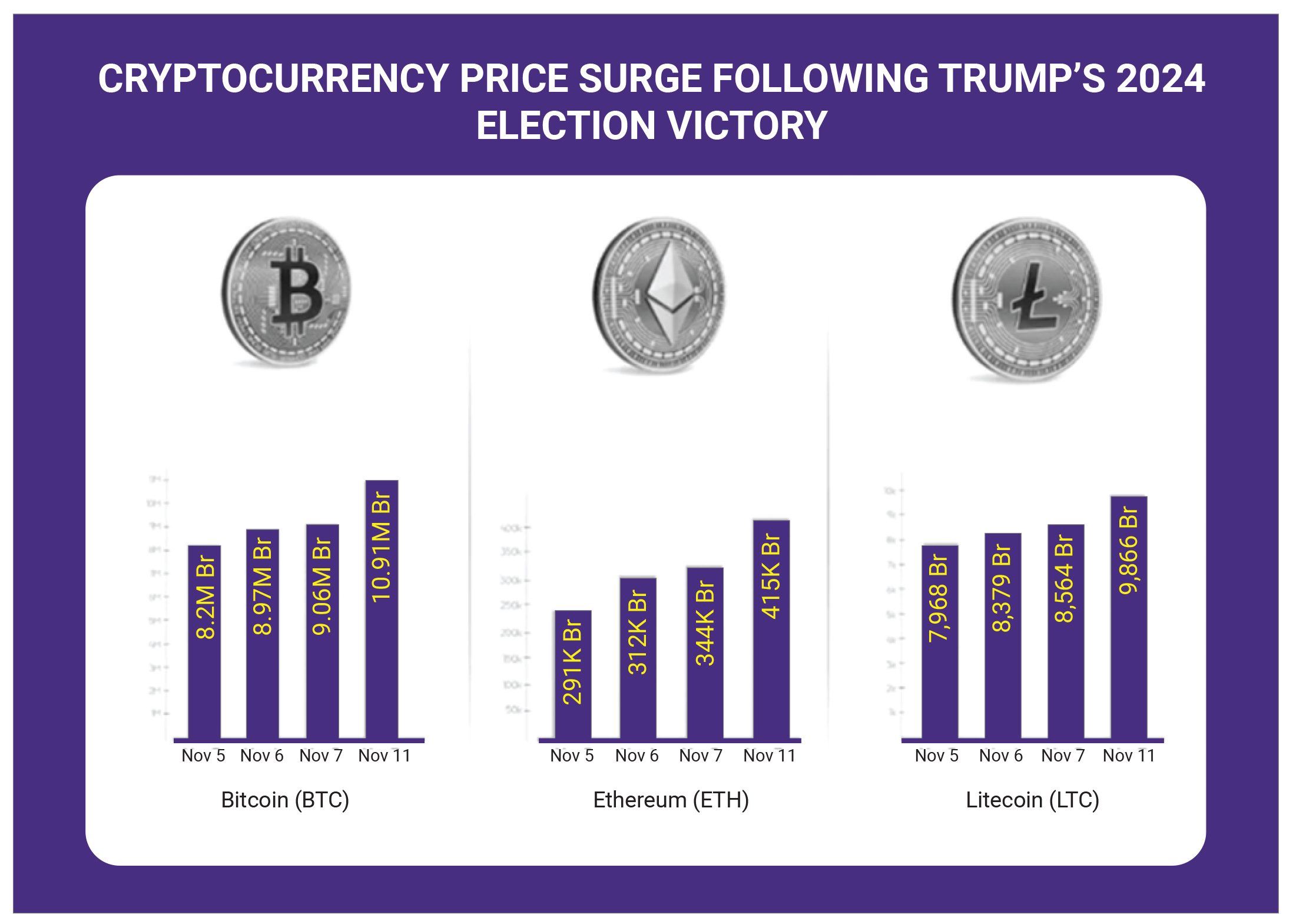

After Donald Trump’s victory in the US presidential elections in November 2024, cryptocurrency rallied as he promoted himself as a supporter of digital currencies, also pledged to make the US the ‘Crypto Capital of the planet’. Investors anticipated that Trump's administration would provide clearer and potentially more lenient regulations for the crypto industry. This expectation was fuelled by his promise to remove Gary Gensler, the SEC chair known for stringent oversight of cryptocurrencies, which many in the industry viewed as a barrier to growth. Bitcoin exchange-traded funds (ETFs) experienced significant inflows, with reports indicating around $1.3 billion flowed into these funds within a single day after Trump's victory. This influx is seen as a strong indicator of institutional interest and confidence in Bitcoin's future. The overall cryptocurrency market saw substantial gains, with Bitcoin reaching new all-time highs above $89,000 shortly after the election results were confirmed. Other cryptocurrencies like Dogecoin also experienced significant price increases, indicating a broader bullish trend across the market. Speculative trading in futures markets also contributed to the rally, with investors betting heavily on Bitcoin's price climbing past $90,000. Indian cryptocurrency exchanges reported a dramatic increase in trading volumes, with some exchanges experiencing trading activity that surged 4 to 9 times compared to previous months. For instance, daily trading volumes on certain platforms reached as high as $36.5 million, up from just $5.8 million before November 6, 2024. Reports indicated that new user signups on crypto platforms increased by 4 times, and trading volume surged by 9 times compared to the previous week. This indicates a robust return of retail investors to the cryptocurrency space. While exact figures for total investments by Indian investors in cryptocurrencies for November 2024 are not specified, the substantial increase in trading volumes and user engagement suggests a significant uptick in investment activity during this period. The combination of favourable market conditions and heightened investor interest post-election has positioned the Indian cryptocurrency market for continued growth and participation from retail investors.