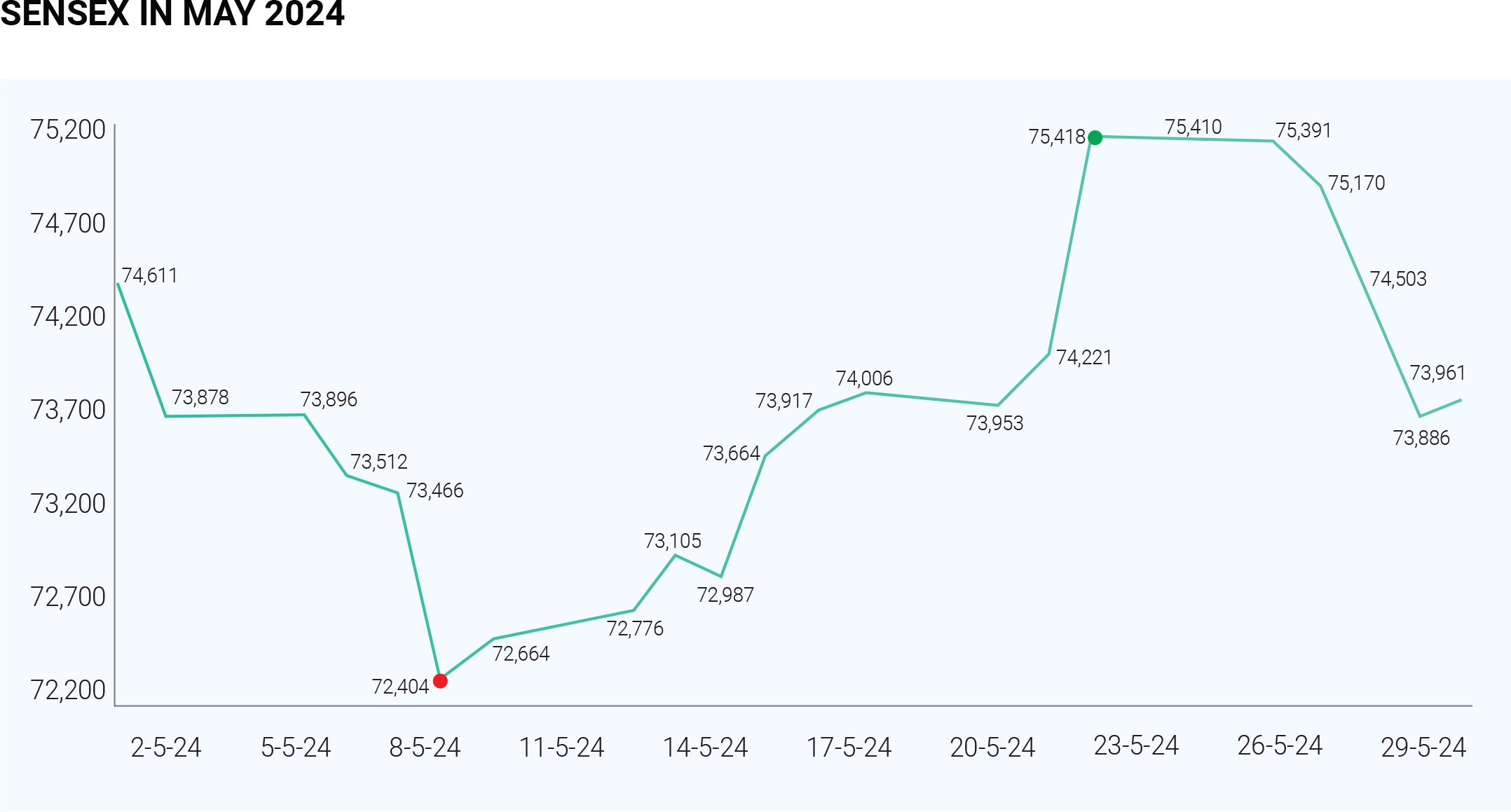

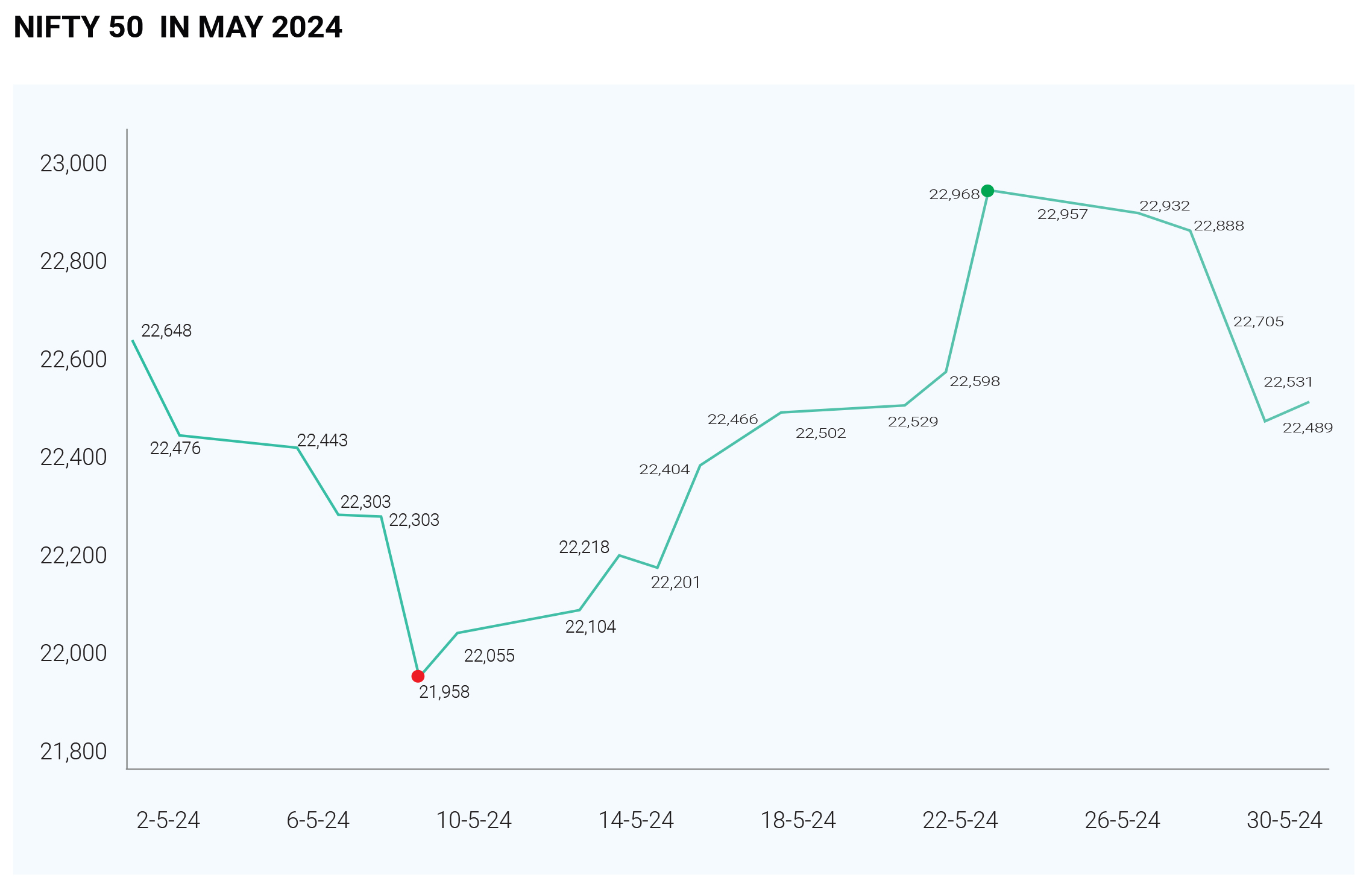

The Indian stock market concluded May 2024 on a lacklustre note, with major indices like Sensex and Nifty consolidating within a narrow range. The broader market also lacked momentum, reflecting investor caution. On May 30th, Sensex closed at 74,095.92, down 0.55% (407 points) after opening marginally lower (0.18%) at 74,356.90. Nifty 50 hovered around the 23,000 mark but ended the month slightly below 22,900 with a minor loss.

Many factors contributed to the muted performance like

weak global signals, volatility of F&O monthly expiry,

escalating geopolitical tensions in West Asia, ongoing

election jitters, and lastly the negative advance-decline

ratio and stock-specific corrections indicated the weak

market breadth, indicating a lack of widespread

participation.

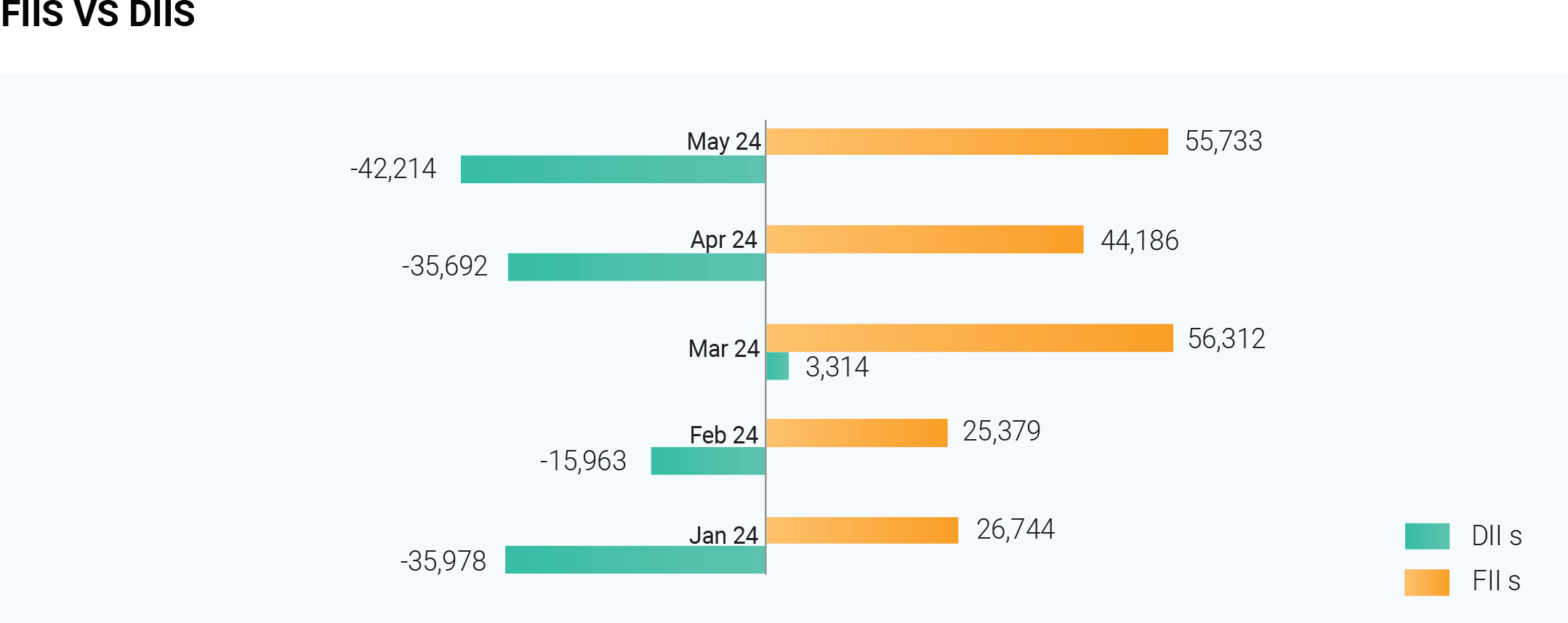

As the FIIs Pull back domestic investors supported the

market. Despite a positive underlying trend, the Indian

market witnessed significant foreign selling in May

2024.This aligns with the "Sell in May and go away"

adage, with FIIs offloading Rs. 25,600 crore worth of

Indian stocks. This shift likely reflects portfolio

rebalancing ahead of the upcoming Lok Sabha elections

results. FIIs dramatically increased their short positions

on May 30th, jumping from 5,000 contracts to a

staggering 2.97 lakh contracts in a single day. Concurrently, their long positions shrunk by 80%, representing the largest net outflow since January 2024. This selling extends beyond India, with FIIs pulling funds from other Asian markets as well. Domestic institutional investors (DIIs) provided counterweight to the FII selling, consistently buying Indian equities and upholding market support. The reason why FIIs are pulling back can be attributed to strong performance of Chinese stocks, increasing US bond yields, relatively high valuations of some Indian sectors, like financials and IT, and lastly disappointing earnings reports in certain sectors. However, the outlook is not entirely bleak. A stable outcome from the elections, coupled with India's strong GDP growth, manageable inflation, and potential for a pause in monetary tightening by the RBI, could entice FIIs to return as buyers.

Large-cap stocks largely followed the broader market

trend, rising by about 0.18% on May 30th, nearly matching

the Nifty 50's performance. The real estate and utilities

sectors were the key drivers of gains within large caps.

Notably, the real estate sector has delivered impressive

triple-digit returns year-to-date (FY24). Mid-cap stocks

emerged as the outperformers, with the Nifty Midcap 100

index surging by a significant 59% in FY24. Small-cap

stocks also witnessed strong gains, with the Nifty

Smallcap 100 index climbing 69% year-to-date.

May 2024 offered a mixed picture of the Indian economy.

While positive signs emerged in sales revenue and GDP

growth, profit performance and political uncertainty

presented challenges. Sales revenue growth in Q4 was

encouraging, exceeding growth in previous quarters. This

upswing, largely driven by the banking sector, suggests a

pick-up in business activity. Despite the sales growth,

profits lagged due to cost pressures and banks facing

difficulties in thinner markets. A bright spot was Q4's GDP

growth of 7.8%, exceeding market expectations of 6.5%.

This indicates a robust and growing economy. Current

political landscape likely caused investor caution and

contributed to market volatility.

The Indian bond market enjoyed a welcome rally in May

2024, fueled by a combination of positive domestic and

global factors. A stronger fiscal position at home, coupled

with reassuring news about inflation abroad, boosted

investor confidence. However, concerns lingered about

the potential for rising U.S. yields to dampen the positive

momentum. The rally saw yields on Indian government

bonds (IGBs) decrease by 12-15 basis points (bps).

Notably, the benchmark 10-year yield dipped below the

psychologically important 7% mark, a boon for investors

seeking stable returns.

The Indian rupee enjoyed a two-month high in May 2024,

closing at its strongest level since March 19th. On May

26th, it settled at 83.0975 against the U.S. dollar. This

appreciation was influenced by global factors, including

movements in U.S. bond yields and the Federal Reserve's

monetary policy decisions.

Gold prices in India, however, presented a mixed picture in

May. While the price of 10 grams of 22-carat gold

fluctuated throughout the month, it closed at Rs. 67,888

on May 31st, compared to Rs. 65,908 on May 1st.

Analysts anticipate a potential rise in gold prices in the

coming quarters, driven by factors like global economic

uncertainty and the upcoming festive season, which

typically sees a surge in gold demand.

In May 2024, crude oil prices experienced a decline, as on

May 28, 2024, the Brent crude oil price stood at $84.23 per

barrel, compared to $79.83 for WTI oil. The Brent July

contract closed at $81.62 per barrel, a decrease of 24

cents or 0.29%. Factors contributing to the decline in oil

prices includes – health of global economy and oil

demand, easing Middle East tensions, sluggish oil

demand and expectation of prolonged high interest rates.

However, OPEC+ is expected to extend its ongoing

voluntary output cuts of 2.2 million barrels per day at its

upcoming meeting, which could increase the price.

The Indian markets in June 2024 are expected to be

influenced by several factors, including the outcome of

the general elections, monetary policy decisions, and

global economic trends. A stable government, cautious

monetary policy, and positive global economic trends

could lead to increased investments and a positive

market outlook.