The impending Indian general elections cast a shadow of uncertainty over the stock market, with investors feeling apprehensive. Despite the looming elections, April 2024 witnessed the Indian equity market scaling new heights for the third consecutive month. The benchmark indices, Nifty 50 and Sensex, closed April flat, propelled by robust performance in the banking and auto sectors. However, the technology sector endured a second consecutive month of losses. April saw Nifty Bank, Nifty Realty, Nifty Metal, and Nifty Auto indices register record highs, highlighting investor confidence in these sectors.

Buoyed by positive domestic manufacturing and services data for March 2024, coupled with strong credit growth in the banking sector during Q4FY24, the Indian equity markets commenced April on a high note. However, escalating tensions in the Middle East dampened investor sentiment. Reassurance from Iranian officials regarding the absence of an immediate response against Israel in the last week of April alleviated global market anxieties arising from potential escalation in West Asia, leading to a resurgence in equity markets worldwide. India's robust growth prospects, coupled with the expectation of political stability ushered in by the commencement of Lok Sabha elections, drew investor interest to the domestic markets. The outcome of the elections and a potential pause in government capital expenditure are likely to engender volatility in the Indian equity markets during May. Additionally, the possibility of a Federal Reserve rate cut in June 2024, based on their economic data, could further influence market behaviour. Meanwhile, advancements in artificial intelligence in China and Japan are poised to positively impact their respective equity markets. April 2024 witnessed a shift in foreign portfolio investment (FPI) activity in India. Following two months of net buying, FPIs became net sellers of Indian equities, offloading ₹8,671 crore worth of shares. This shift can be attributed to several factors, including rising US bond yields, higher crude oil prices, and unexpectedly high US inflation data. The latter dampened hopes for an early interest rate cut by the Federal Reserve, thus keeping yields elevated and prompting capital outflows. Despite the change in FPI behaviour, Indian benchmark indices delivered positive returns and even reached new highs in April. This resilience stemmed from strong domestic investor participation, improving macroeconomic data, and decent corporate earnings for the March quarter. Notably, FPIs also turned net sellers in the Indian debt market for the first time in over a year, withdrawing ₹10,949 crore after a 12-month period of continuous net buying totalling ₹1.2 lakh crore. Gold prices experienced a significant increase in April due to rising geopolitical tensions in the Middle East. Additionally, initial expectations of a potential Federal Reserve rate cut in June 2024, fuelled by weaker US inflation figures, prompted investors to seek the safe haven of gold. However, as anxieties surrounding the Middle East conflict subsided, gold prices declined. Nevertheless, the price decrease remained moderate as US inflation data ultimately met expectations. Gold opened April at $2,280 per ounce and closed the month at $2,334 per ounce, reflecting a rise of over 2%. Disappointing economic data for the first quarter of the US financial year further influenced market sentiment. Weaker-than-anticipated US growth projections cast doubt on the near-term possibility of a Fed rate cut. This triggered profit-taking in the gold market, as investors shifted their holdings from precious metals to currencies and bonds. Global oil prices initially surged in April due to an intensification of the Middle East conflict. However, this upward trend was tempered by the release of negative US economic data towards the month's end, which dampened demand for crude oil. The Indian Rupee also exhibited volatility following the central bank's MPC meeting, where interest rates were held steady. This, along with ongoing uncertainty surrounding US Federal Reserve rate hikes, exerted pressure on the dollar.The stock market was expected to experience volatility, mirroring a pre-election rally but ultimately ending flat due to conflicting signals. While initial sentiment was positive, fluctuations in global markets and declines in certain major stocks offset the early gains. The anticipated correction in oil prices initially fuelled a positive outlook for domestic markets. However, a mixed reaction in the global market following the Fed's policy announcement, which expressed caution about maintaining high inflation, led to a broad correction in the domestic market. Additionally, ongoing geopolitical conflicts continued to exert pressure on the economy.

In a joint operation on 27th April, Indian and US authorities cracked down on a major drug trafficking ring that used cryptocurrency for transactions. The Enforcement Directorate (ED) and the Federal Bureau of Investigation (FBI) collaborated on raids in Uttarakhand's Haldwani district, seizing over $360 million in digital currency (crypto) linked to the drug operation. The investigation began in August 2023 based on a tip from the FBI regarding two suspects involved in international drug trafficking. These suspects allegedly sold drugs through online advertisements and dark web vendors, accepting crypto payments. This case highlights the growing concern around cryptocurrency-facilitated crime, particularly in smaller cities of India. As India's crypto market flourishes, regulations are still under development. Cryptocurrency is a digital asset secured by a vast network of computers. Unlike traditional currencies, it operates outside the control of central banks or governments. Introduced in 2021, the Cryptocurrency and Regulation of Official Digital Currency Bill aimed to establish a framework for a government-issued digital currency by the Reserve Bank of India (RBI). However, its passage has been delayed, with the Ministry of Finance raising concerns during the current parliamentary session. The debate surrounding cryptocurrency's legality and benefits continues globally. While some countries embrace its decentralised nature, others remain cautious. Regulations aimed at countering money laundering and terrorism financing (AML/CFT) may be implemented by some nations to limit its misuse for such purposes.

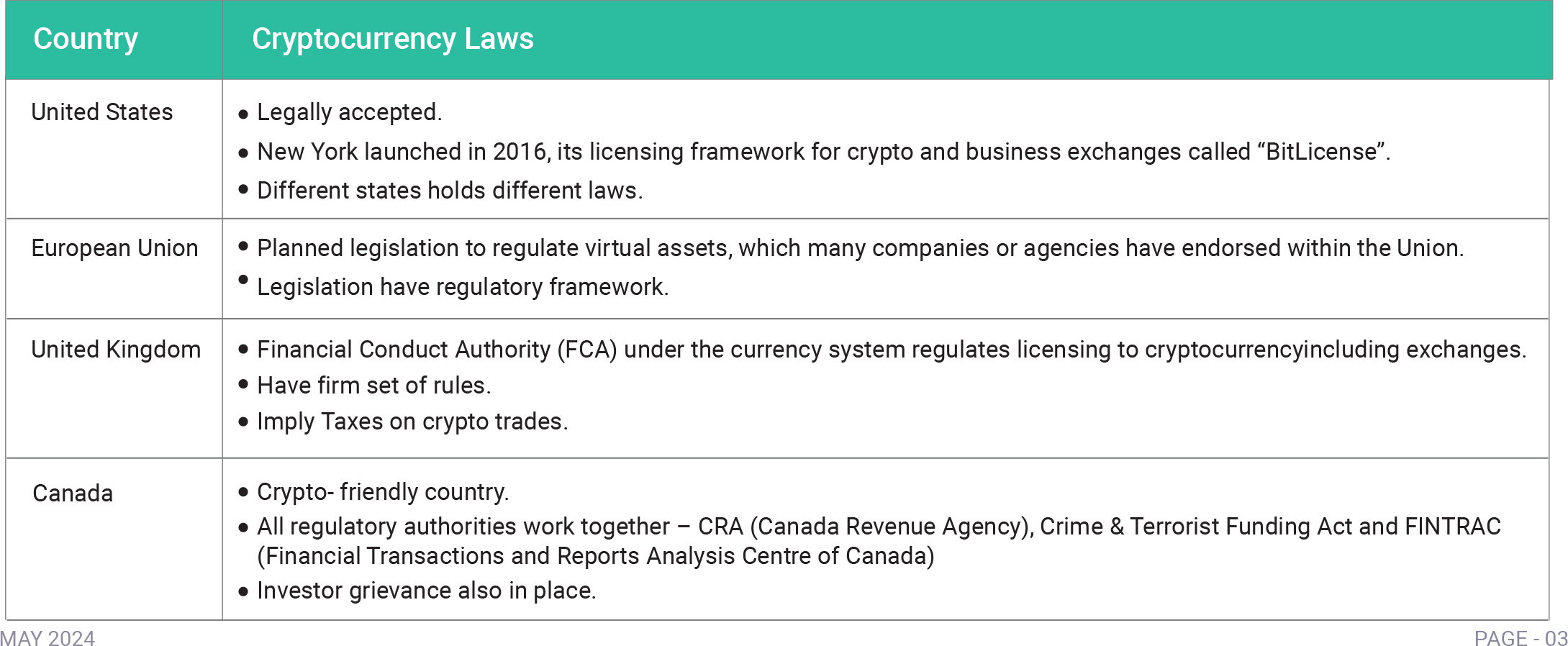

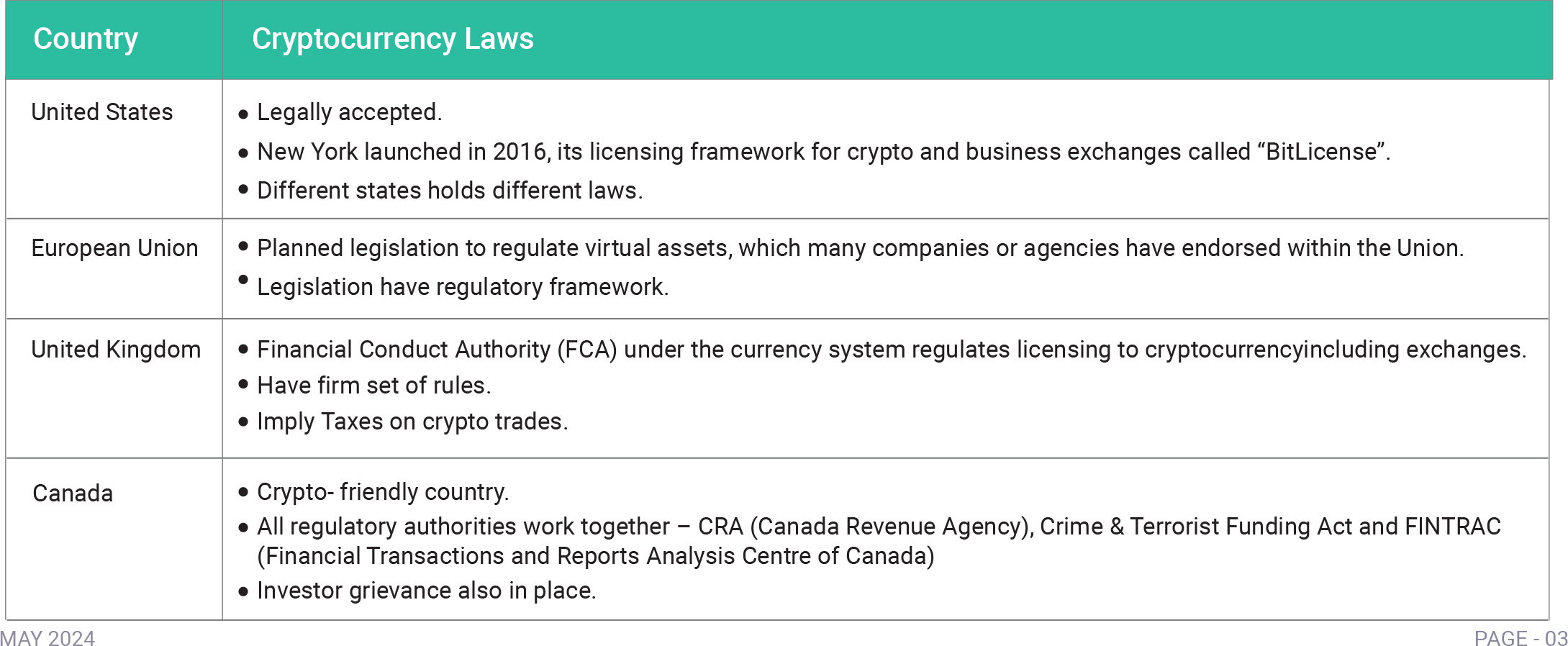

Several countries have banned cryptocurrency

altogether, including China, Bangladesh, Egypt, Morocco,

Nepal, Iraq, Tunisia, and Qatar. While India doesn't

currently have a law in place specifically banning crypto,

the Cryptocurrency Bill 2021 is still under development.

In the meantime, the government has begun taxing

virtual assets as part of the 2022 Union Budget

Few terminologies of Cryptocurrency world: FUD (fear, uncertainty & doubt) : A strategy used to influence people’s perception of crypto through the spreading of negative, misleading or false information. Halving : It is a process that reduces the number of new coins created in a cryptocurrency’s blockchain. Mining rigs : They are specialized computers, customized for cryptocurrency mining. A miner is used to help process transactions and secure the network of a cryptocurrency that uses a Proof-of-Work algorithm. When Lambo : the point at which crypto holders will be rich enough to buy a Lamborghini. Flash Crash : When the price of an asset drops drastically in a short period of time and then returns to the previous levels in the same amount of time.

A 2023 report found that millions of Indian crypto users (3-5 million) have switched to foreign exchanges, taking $3.8 billion in trading volume with them. This shift is attributed to India's high crypto taxes (1% TDS and 30% capital gains tax with no loss offsetting). To effectively regulate crypto, policymakers need to recognize it as a financial asset.

Copyright © 2021 Fintso